About Us

We started with humble roots in Colorado, making deals with a handshake. Now, we utilize a sophisticated, data-driven approach to make intelligent investments in energy projects across the continental United States.

Firm History

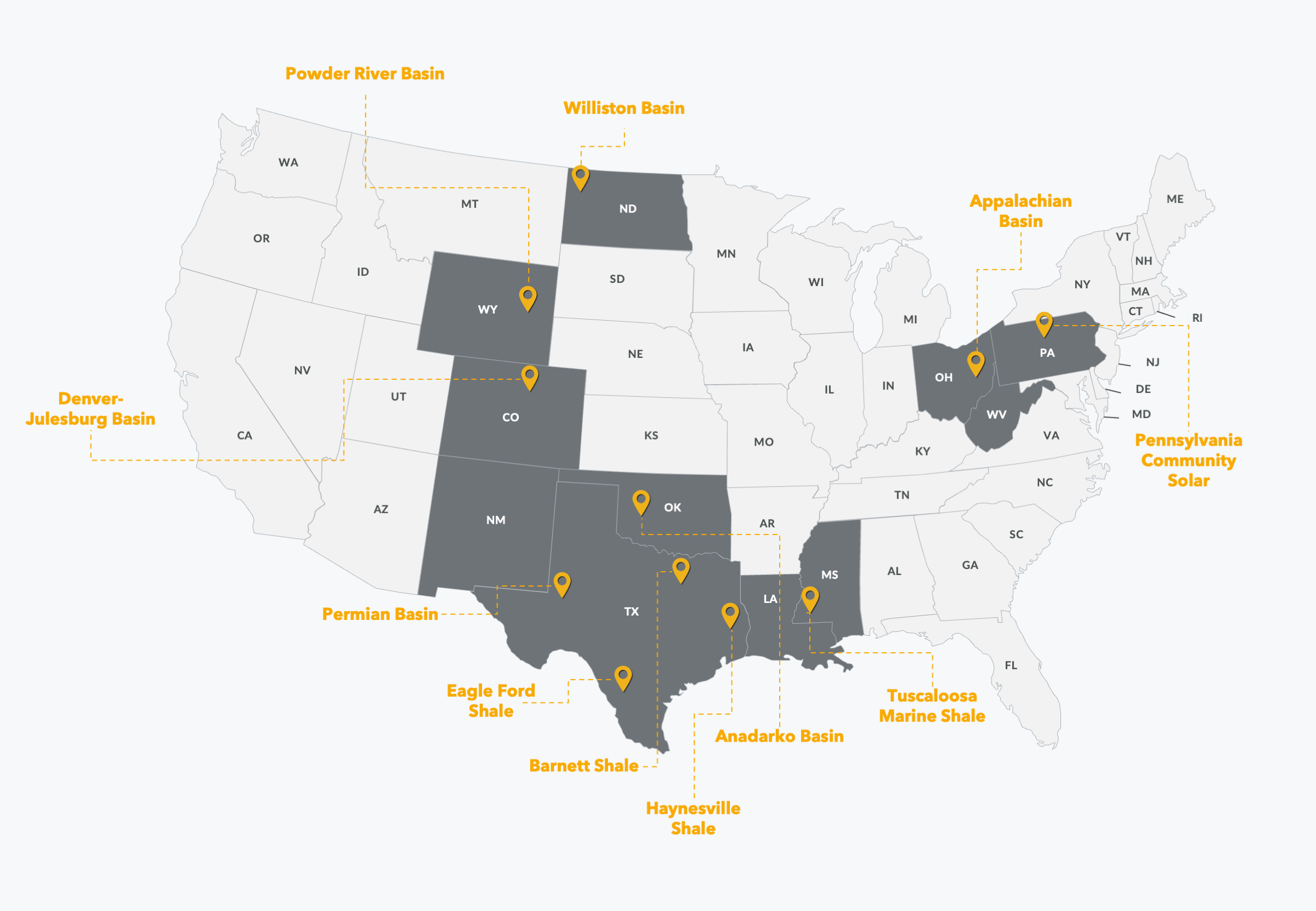

Lincoln was founded in 2013 to make investments in mineral rights, royalty interests, non-operated working interests and leasehold in the DJ Basin in Colorado. Since then, the partnership has grown to upwards of 15 professionals, managing capital on behalf of institutions and individuals, and making investments in ten different states across various energy projects. After completing several successful full-cycle projects in Colorado, Wyoming, and North Dakota, Lincoln continues to press its investment acumen with significant co-investment alongside its capital partners.

Core Strengths

Big Data

Lincoln uses a "big data" approach to combine geologic, engineering and land data which is used to understand the nuances of multi-basin investing and direct asset acquisition efforts.Nimble Culture

Lincoln acts quickly and decisively to capitalize on the always-evolving nature of energy development.Development Experience

Lincoln's team members have experience developing energy projects, allowing us to view and underwrite assets from the operator's perspectiveWell Capitalized

Lincoln invests on behalf of institutions, banks, high-net-worth individuals, and its own balance sheet and has access to capital to close deals which we contract.

Areas of Interest

Lincoln owns conventional and renewable energy assets across the continental U.S.